The potash market is winding down after operating in what some observers have called a “new world”. Exporters are now bracing themselves for what is looking to be a gruelling year of defending market share amid bearish demand. This can be illustrated with the news that traders are now offering Belarusian MOP into the US – for the first time in almost 6 years. The new BPC has developed something of a reputation over the course of the year as being a force to be reckoned with; the combination of a savvy sales team coupled with strong demand in almost in every market globally has seen the Belaruskali drastically expand its market share. In 2015’s market where demand could well be less, many observers are keen to see to what extent price discipline will be maintained.

Today, and looking towards 2015, demand is looking quite flat – or potentially even softening. With this in mind there’s a lot of attention of Uralkali’s potential $1 billion write off at its Solikamsk-2 mine. Uralkali said in its Q3 market update, it constitutes around 2.3 million t/y and without it – even factoring in debottlenecking at Berezniki-2 and Berezniki-3 as well as supplying the granulation facility at Solikamsk-2 with ore from Solikamsk-3 – Uralkali’s production would be nearer 10.2 million t, down from this year’s 12 million t figure. In addition to swinging the supply/demand balance more in favour of suppliers, it would also apply pressure on Uralkali to maximise MOP prices to try and compensate for some of the loss. The reality of the situation, however, is far from crystal-clear and until Uralkali is able to conduct a thorough geotechnical analysis of the mine, then all the market can do is hedge its bets.

Naturally, this will be a key conversation topic at the negotiating table for the 1-half 2015 contract with China. Today there’s little to update on this matter as both sides wish to avoid expressing anything which may hinder them. Something which will support both of their arguments – probably to the point of stalemate – is the fact that there are significant macroeconomic concerns which will inevitably impact both parties. Russia is under significant pressure with tumbling oil prices which is wreaking havoc with the rouble. Further, there’s no light at the end of the tunnel as far as frosty relations with the West are concerned, which limits Russian companies’ access to foreign capital. China is forecast to have a challenging 2015 with most experts forecasting its GDP growth to increase at a lower rate next year. The implication of this is that it could impact the yuan’s value on the international market, and if that happens then all imports – MOP or otherwise – are going to feel much more expensive.

Likewise in Europe, one of the main concerns being cited by farmers, and indeed the most pronounced factor looming over the European agriculture market in general, is macroeconomic. The expectation that 2015 will see some contraction in Germany’s trade surplus is underpinning concerns that Europe could succumb to a “triple-dip” recession.

Those concerns were further fuelled in October when the European Central Bank announced that it was considering embarking on its own quantitative easing programme. Observers have warned that should this scenario unfold then potash will feel much more expensive due to the lower euro value; this could be further exacerbated should K+S come under pressure to shift its sales and marketing focus to dollar-pegged export markets rather than lower-return European markets. It must be said, however, that with Europe being such a logistically advantageous market for K+S then any depreciation in the euro against the dollar would need to be quite drastic in order to make such a move viable.

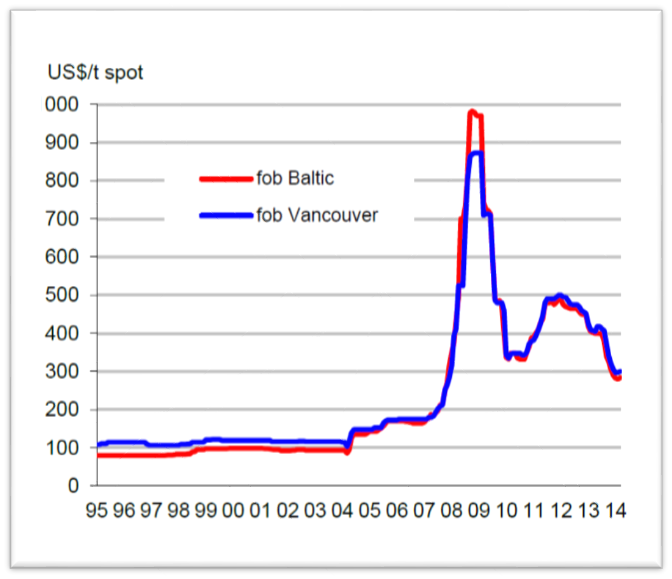

Analysis of potash prices in 1995 – 2014 years