2014 was drawing to a close amid some uncertainty in terms of contract prices, particularly in Europe where there were contrasting indications. As expected, sellers were targeting increases to improve margins, but struggling end-users and traders operating on thin margins voiced their concerns and said they would be sticking to their guns demanding a rollover in Q1. In these negotiations, there has yet to be any settlement although one major seller was reported to be firmly targeting an increase ex- France. In most cases, there were varying differentials in price ideas and thus negotiations were expected to continue well into January.

In China, demand appeared to have improved and some buyers were reportedly accepting offers around $175-180 cfr, with talk of the $180s cfr for January arrivals. On the back of this, one major Canadian supplier indicated it was targeting the mid $150s fob with its customers, reflecting double digit increases over the third quarter.

Outstanding contract business included first quarter business between traders and producers ex-Middle East and ex-FSU and these are already being negotiated but due to the various holidays they are likely to be drawn out well into the New Year.

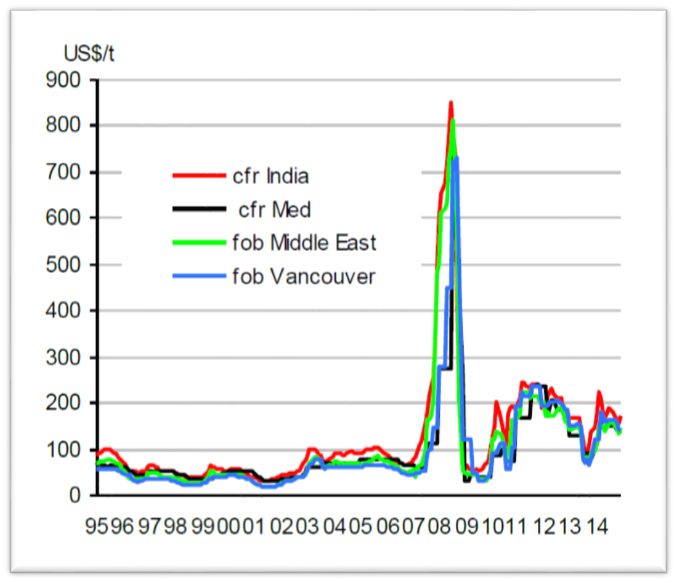

Overall, 2014 was a year of some price volatility with sulphur prices starting the year at highs of nearly $200 cfr China, but then plunging to the low $100s by the third quarter as consumption in China dropped. 2015 will likely see new supply come to the market not only from the Middle East but also in Turkmenistan, China and also to some extent in India with new refineries starting up. Additional supply will start to gain pace next year, increasingly entering into a possible surplus situation towards the end of the year. Although demand in China continues to grow and there were new sources of demand emerging such as the metal leeching industry, the longer term outlook remains in favour of consumers.

Analysis of sulphur prices in 1995 – 2014 years